Real estate equity crowdfunding is a growing trend in the field of real estate investing. It allows investors to buy shares of properties or projects through online platforms, such as CrowdStreet, Fundrise, RealtyMogul, and DiversifyFund. By doing so, investors can access a variety of real estate opportunities, from residential to commercial, from single-family to multifamily, and from development to income-producing.

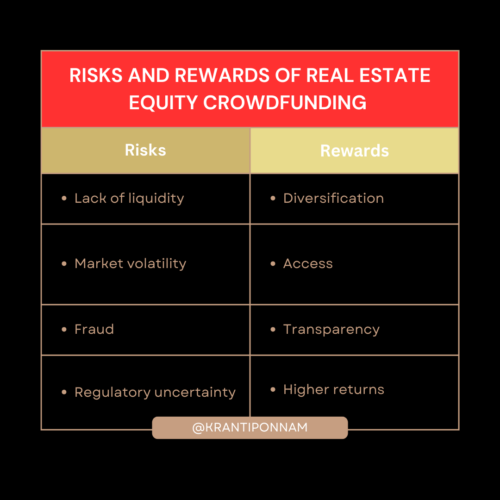

But what are the risks and rewards of real estate equity crowdfunding? How does it compare to other forms of real estate investing? And what are the legal and regulatory aspects of this emerging industry? In this blog post, we will explore these questions and provide some insights for potential investors.

Risks of Real Estate Equity Crowdfunding

As with any investment, real estate equity crowdfunding involves some risks that investors should be aware of some of the common risks include:

- Lack of liquidity: Unlike stocks or bonds, real estate investments are not easily traded or sold. Investors may have to wait for years before they can exit their investments or receive dividends. Moreover, some platforms may charge fees or penalties for early withdrawals or transfers.

- Fraud: Although most platforms conduct due diligence and background checks on the sponsors and properties they list, there is still a possibility of fraud or misrepresentation. Investors should always verify the information provided by the platforms and the sponsors, and seek independent advice if needed.

- Regulatory uncertainty: Real estate equity crowdfunding is a relatively new phenomenon, and the laws and regulations governing it are still evolving. Different platforms may operate under different exemptions or rules, depending on the type and amount of investment they offer. Investors should be familiar with the SEC rules, the JOBS Act, and the limits on investment amounts that apply to their chosen platforms and deals.

- Market volatility: Real estate markets are subject to fluctuations and cycles, depending on various factors such as supply and demand, interest rates, economic conditions, and location. Investors should be prepared for the possibility of losing some or all of their invested capital if the market turns against them.

Rewards of Real Estate Equity Crowdfunding

Despite these risks, real estate equity crowdfunding also offers some rewards that may appeal to investors. Some of the common rewards include:

- Diversification: Real estate equity crowdfunding enables investors to diversify their portfolio across different types of properties, locations, strategies, and risk profiles. Investors can also spread their capital among multiple deals, reducing their exposure to any single investment.

- Access: Real estate equity crowdfunding lowers the barriers to entry for real estate investing. Investors can participate in deals that were previously reserved for institutional or accredited investors, with as little as $500 or $1,000. Investors can also access deals that are not available in their local markets, expanding their geographic reach.

- Transparency: Real estate equity crowdfunding platforms provide investors with detailed information about the sponsors and properties they list, such as financial projections, market analysis, legal documents, and updates. Investors can also communicate with the sponsors and other investors through online forums or chat rooms.

- Higher returns: Real estate equity crowdfunding can potentially generate higher returns than other forms of real estate investing, such as REITs or mutual funds. This is because investors can directly benefit from the appreciation and cash flow of the properties they invest in, without paying high fees or commissions to intermediaries.

Conclusion

Real estate equity crowdfunding is an exciting and innovative way of investing in real estate. It offers investors a chance to access a variety of real estate opportunities, diversify their portfolios, gain transparency, and earn higher returns. However, it also involves some risks that investors should be aware of, such as lack of liquidity, fraud, regulatory uncertainty, and market volatility. Investors should always do their own research and due diligence before investing in any deal, and consult with professional advisors if needed.

If you are interested in learning more about real estate equity crowdfunding, you can visit my website to know more and how you can get started. You can also subscribe to my YOUTUBE CHANNEL for more tips and insights on real estate investing.

I hope you enjoyed reading this blog post. 😊