If you’re looking for a way to invest in real estate and generate passive income, you might have heard of the 1% rule. But what is it exactly and how can you use it to find profitable properties? In this blog post, we’ll explain what the 1% rule is, how to calculate it, when to use it and when to ignore it. We’ll also give you some examples of properties that pass or fail the 1% rule and some alternatives to consider.

What is the 1% Rule in Real Estate?

The 1% rule is a simple formula that helps investors measure the potential cash flow of a rental property. It states that the monthly rent of a property should be equal to or greater than 1% of the total investment in the property. The total investment includes the purchase price plus any repairs or improvements needed to make the property rentable.

The 1% rule helps investors quickly screen properties and compare them based on their rental income potential. It also helps investors set a realistic rent price that covers their mortgage payments and other expenses.

For example, if you buy a property for $200,000 and spend $10,000 on repairs, your total investment is $210,000. According to the 1% rule, your monthly rent should be at least $2,100 ($210,000 x 0.01). If you can charge more than that, you’ll have a positive cash flow. If you can’t charge that much, you’ll have a negative cash flow.

How to Calculate the 1% Rule

Calculating the 1% rule is very easy. All you need to do is multiply the total investment in the property by 0.01 or move the decimal point two places to the left. For example:

- If your total investment is $150,000, your monthly rent should be $1,500 ($150,000 x 0.01).

- If your total investment is $300,000, your monthly rent should be $3,000 ($300,000 x 0.01).

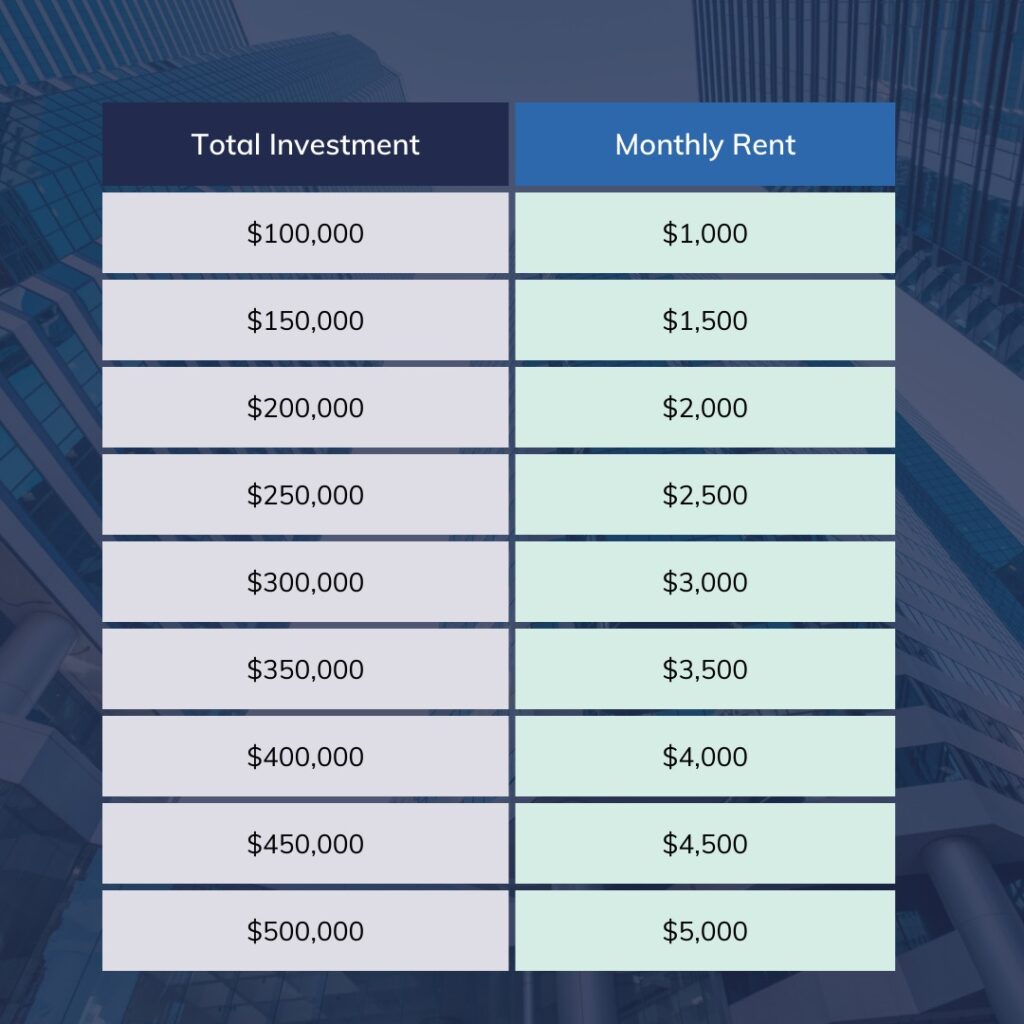

You can also use this table to quickly find the monthly rent based on different investment amounts:

When to Use the 1% Rule in Real Estate Investing

The 1% rule is a useful tool for real estate investors who want to find properties that generate positive cash flow and have a good return on investment (ROI). It can help you narrow down your search and avoid properties that are overpriced or underperforming.

The 1% rule can also help you set a realistic rent price that covers your mortgage payments and other expenses such as taxes, insurance, maintenance and vacancy. By charging at least 1% of your total investment in rent, you can ensure that you have enough income to pay off your debt and make a profit.

However, the 1% rule is not a hard-and-fast rule that applies to every property and every market. It’s just a guideline that can help you make informed decisions based on your goals and preferences.

When to Ignore the 1% Rule in Real Estate Investing

As helpful as the 1% rule can be, there are some situations where you might want to ignore it or use other criteria to evaluate a property. Here are some examples:

- The property is located in a high-demand or high-growth area where rents are expected to increase significantly in the future.

- The property has other sources of income besides rent such as parking, laundry, or storage fees.

- The property has the potential for appreciation due to its location, condition or features.

- The property offers tax benefits such as depreciation or deductions.

- The property meets your personal or lifestyle goals such as living in it part-time or using it as a vacation home.

In these cases, you might be willing to accept a lower rent-to-investment ratio because you expect to make money from other factors besides cash flow.

Alternatives to the 1% Rule

The 1% rule is not the only way to evaluate a rental property. There are other methods and metrics that can help you analyze a property’s performance and profitability. Some of them are:

- The 2% rule: This is a more aggressive version of the 1% rule that requires the monthly rent to be equal to or greater than 2% of the total investment in the property. This rule is harder to meet but can result in higher cash flow and ROI.

- The 50% rule: This is a rule of thumb that estimates that 50% of the gross rent will go towards operating expenses such as taxes, insurance, maintenance and vacancy. The remaining 50% will go towards your mortgage payment and cash flow. This rule can help you estimate your net income and cash-on-cash return.

- The cap rate: This is a metric that measures the annual net income of a property divided by its current market value. It shows the percentage return that an investor can expect from buying a property with cash. A higher cap rate means a higher return and a lower price.

- The cash-on-cash return: This is a metric that measures the annual net income of a property divided by the amount of cash invested in the property. It shows the percentage return that an investor can expect from buying a property with financing. A higher cash-on-cash return means a higher return and a lower down payment.

Conclusion

The 1% rule is a simple and effective way to find profitable rental properties and set realistic rent prices. It can help you quickly screen properties and compare them based on their cash flow potential. However, it’s not a one-size-fits-all rule that applies to every property and every market. You should also consider other factors such as appreciation, tax benefits, personal goals and market conditions when evaluating a property. You should also use other methods and metrics such as the 2% rule, the 50% rule, the cap rate and the cash-on-cash return to get a more accurate and complete analysis of a property’s performance and profitability.

We hope this blog post has helped you understand what the 1% rule is, how to calculate it when to use it and when to ignore it. If you’re looking for more tips and advice on real estate investing, check out our other blog posts or contact us today. We’d love to help you find your dream property and achieve your financial goals.